The Government of lndia has announced that starting 1st October 2023, a 28% Tax (GST) will beapplicable on all cash deposits.

What it means:

GST will only be deducted at the time of adding cash to your account.

GST will not be deducted from the entry fee or for the number of games played.

Note: The cash amount you add to your account will be inclusive of 28% GST.

A player who deposits ₹100 will receive ₹78.12 in their account after a 28% GST deduction of ₹21.88.

HOW WILL IT IMPACT ME?

Good News! Ruby Rummy will give you a 100% cashback for the GST paid by you.

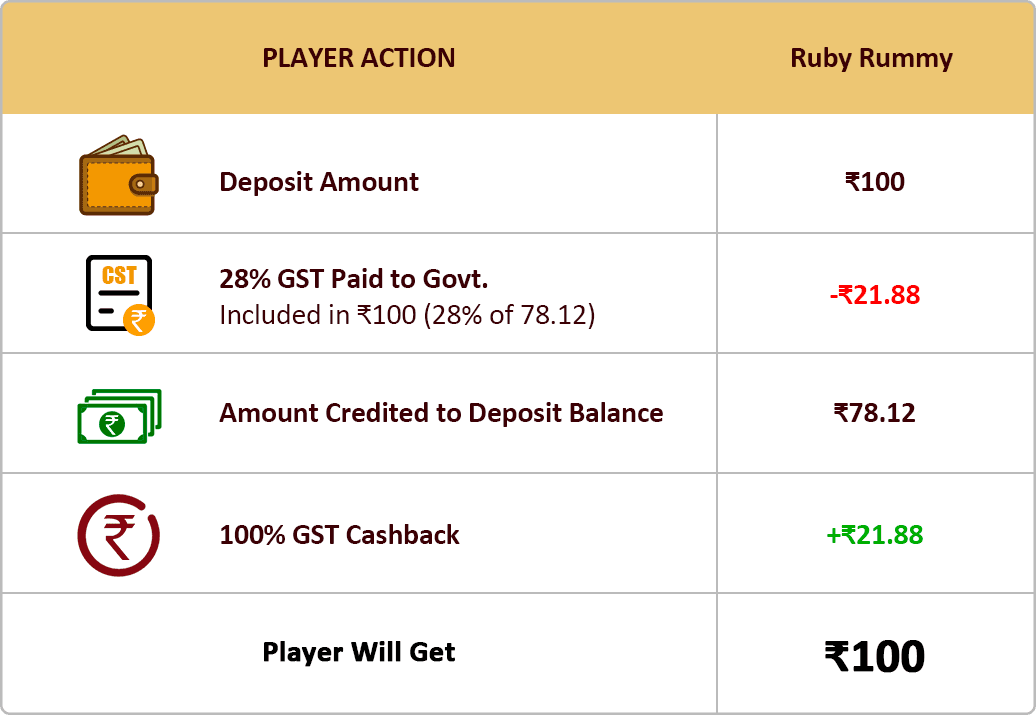

Let’s understand this with an example:

If you deposit ₹100, you will get the full amount of ₹100 in your account.

| PLAYER ACTION | Ruby Rummy |

|---|---|

Deposit Amount | ₹100 |

28% GST Paid to Govt. Included in ₹100 (28% of 78.12) | -₹21.88 |

Amount Credited to Deposit Balance | ₹78.12 |

100% GST Cashback | +₹21.88 |

| Player Will Get | ₹100 |

Frequently Asked Questions

What is GST?

GST(Goods and Services Tax) is an indirect tax levied by the government on the supply of goods and services. For online gaming, including online real money gaming, GST is levied on deposits made with the online gaming platforms.

Why are you charging GST?

In the 50th GST Council meeting held on July 11, 2023, the GST Council recommended that 28% GST should be applicable on deposits made with the online gaming platforms. Based on the recommendation, the Government of India amended the Central Goods and Service Tax Act, 2017 and Integrated Goods and Service Tax Act, 2017, applicable with effect from 1 October 2023 and the rules made thereunder. As per this rule, GST at the rate of 28% will be levied on the users on every deposit he makes with an online gaming platform.

How much GST is applicable when I deposit money?

As per the new GST changes by the government, we are required to charge GST at the rate of 28% on every deposit made by a user in his Deposit Account. After we collect the GST amount, we remit it to the government. Example: if you are depositing INR 100 in your Deposit Account, the total amount charged to you will be INR 128 (which will include the GST at the prevailing rate is 28% i.e. INR 28). On payment of INR 128, your Deposit Account will get credited with INR 100 and the remaining amount of INR 28 will be deducted as GST on deposit and remitted to the GST authorities by us.

What is GST cashback?

As per the new GST rule passed by the Govt., 28% GST will apply on deposits on Online Gaming platforms from 1st Oct, 2023. Don’t worry, You will get guaranteed GST cashback on all deposits! Here’s how it will work - Let's say you add ₹ 1000 on Ruby Rummy. GST Amount = 28% of Deposit Amount = ₹ 218.75 (28% of ₹ 781.25) Ruby Rummy will give you GST cashback = (+ ₹ 218.75) You can use the GST cashback balance to enter Cash Games & Tournaments. Keep depositing worry-free!

Follow us on

Security & Certificates

Payment Options